Cohabiting couples should make a Will

Should I get a Will?

The intestacy trap

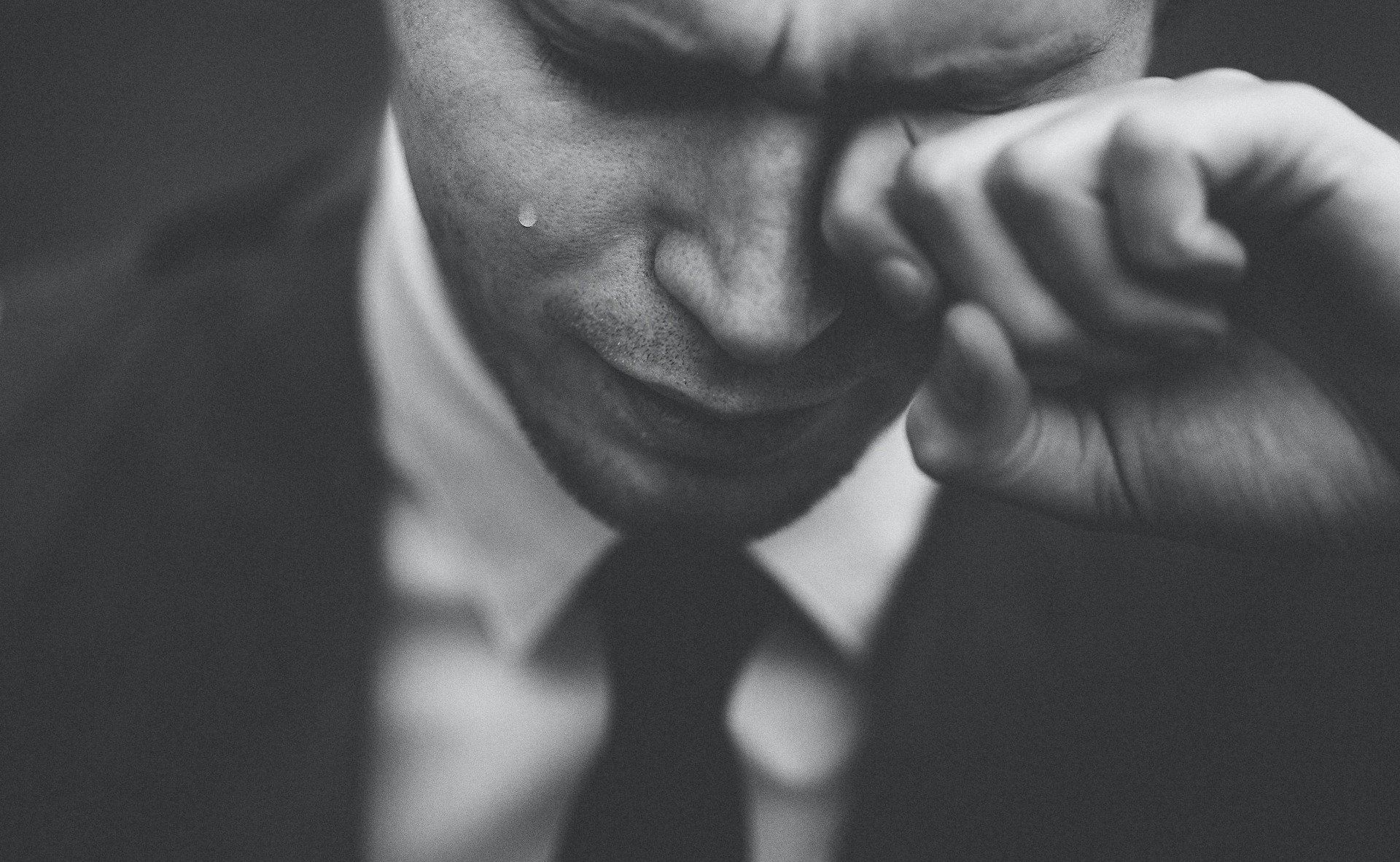

Grieving for the loss of his partner, Pete then found out that, due to the UK’s intestacy laws, he wasn’t entitled to inherit any of Tom’s property, financial assets or belongings, unless they were jointly owned. Despite Pete knowing that Tom had loved him and would want him to inherit, the absence of a Will meant that none of that mattered.

Thankfully, Pete and Tom had owned their property as joint tenants, meaning Tom’s share automatically passed to Pete according to the rights of survivorship. However, without children or any surviving parents or siblings, the remainder of Tom’s assets ended up being passed on to a distant uncle with whom Tom didn’t have any contact.

Now, Pete faces a battle to pay his bills and mortgages without Tom’s savings and investments, life insurance policy and even the car that Tom owned but they both used.

How a Will could have helped

Had Tom got around to writing a Will, he would have been able to specify exactly who would receive what from his estate, including his savings, investments, car and other belongings. In addition to writing a Will, Tom could have made his wishes known, by nominating beneficiaries to his pension and writing life policies under trust. By taking these steps, Pete would have been given the extra financial support he now so desperately needs.

As it stands, Pete still has the legal right to claim against Tom’s estate as they had been cohabiting for more than two years - but this will be a costly and time-consuming process and a positive outcome isn’t guaranteed. If Tom had a Will, this added stress could have been avoided.

Don't put it off

With cohabiting couple families growing faster than married couple and lone parent families, it’s clear that more people are choosing not to get married, just like Tom and Pete. However, there’s a catch. Cohabiting couples have none of the legal protections afforded by marriage, meaning that a Will is one way to ensure your partner inherits according to your wishes. Despite this, research shows three in five UK adults do not have one.

Let us help

Don’t let what happened to Pete, happen to you. Speak to a solicitor or Will writing expert to make sure your loved ones are protected.

The Will writing service promoted here is not part of the Openwork offering and is offered in our own right.

Openwork Limited accept no responsibility for this aspect of our business.

Will writing is not regulated by the Financial Conduct Authority

More information about mortgages

Mortgage news